Lexington law credit

Author: h | 2025-04-24

Lexington Law vs. Credit Saint Credit Saint is one of Lexington Law's top contenders in the industry. Both are popular for leading credit repair and have almost the

Lexington Law vs The Credit Pros

Skip to content--> Call: 1-855-255-0139 for a Free Credit Repair Consultation FREE Credit Report Summary & Credit Repair Consultation Lexington Law offers a free credit repair consultation, which includes a complete review of your FREE credit report summary and score. Call us today to take advantage of our no-obligation offer. Take Control of Your Credit A paralegal is open to review your FREE credit report summary. Call now for your FREE consultation: 1-855-255-0139 Close Category: Credit 101 Categories Credit 101 Credit Cards Credit repair Finance Life Events Loans Negative Items News Uncategorized What is VantageScore 3.0 and how does it work? | February 20, 2025February 20, 2025VantageScore 3.0 is a credit scoring model that the three major credit bureaus use to determine your creditworthiness. Learn how it works and how to change it. Does unemployment affect your credit? REVIEWED BY Lexington Law | January 27, 2025January 27, 2025Filing for unemployment won’t directly affect your credit report or score, but being unemployed can have indirect effects on your credit. 5 ways to build credit without a credit card REVIEWED BY Lexington Law | January 27, 2025January 27, 2025There are many ways you can build credit without a credit card. We cover the top five methods here so you can get started building credit. How long does it take to get a credit card? REVIEWED BY Lexington Law | December 4, 2024December 3, 2024The credit card approval process can take anywhere from a few minutes to 30 days, and mailing takes seven to 10 business days. Read on to learn more. What is credit monitoring and how does it work? REVIEWED BY Lexington Law | December 2, 2024December 2, 2024Credit monitoring is a service that alerts you when there are changes to your credit report. This helps catch suspicious activity early to protect your finances. Get Started Online

Credit help - Lexington Law Firm

Our reviewers evaluate products and services based on unbiased research. Top Consumer Reviews may earn money when you click on a link. Learn more about our process. Monday, March 24th 2025 Credit Repair Company Reviews The Credit Pros 3 plans to choose from (2 that focus on credit repair) 60-day satisfaction guarantee Available in all states except ME, KS, MN, OR "A+” rated by the BBB In business for 14+ years Over one million clients The Credit Pros isn't a credit repair company we can get behind anymore. They've only got two tiers of service specific to credit repair, and both are priced over $100/month. If they had a long track record of effectively helping customers, maybe it would be worth the fee. However, this is one of several companies in our evaluation that are involved in lawsuits, so we're not entirely sure that The Credit Pros are going to stay in business. Our recommendation? Go with a credit repair company that's a lot higher on our list. Lexington Law $139.95/month 50% discount on your first work fee when you sign up with a friend or family member Cancel anytime In operation since 2004 Lexington Law used to be a major player in the credit repair industry. They've handled over 221 million challenges since 2004, and they take a one-size-fits-all to pricing at a flat fee of $139.95/month. That's a lot more expensive than many rival services, but the bigger issue is with Lexington Law's reputation. The company was part of a multi-billion dollar settlement on a lawsuit filed by the CFPB - to the point that they were banned from using telemarketing for 10 years (and they filed for Chapter 11 bankruptcy protection). It should come as no surprise that this credit repair option earns a lower rating now.Free credit repair - Lexington Law

The information provided on this website does not, and is not intended to, act as legal, financial or credit advice. See Lexington Law’s editorial disclosure for more information.A credit privacy number (CPN) is formatted similarly to a Social Security number and is commonly used by fraudulent companies to scam people with bad credit. Using a CPN to apply for credit constitutes fraud, and they’re often tied to criminal activity.A credit privacy number (CPN) is sold to consumers as a product to repair bad credit. In reality, these numbers can be associated with identity theft. The Federal Trade Commission (FTC) considers identity theft to be any instance where a criminal uses someone else’s personal information to “open accounts, file taxes or make purchases.” CPNs can pave the way for such fraudulent activity.Here, we’ll explain what credit privacy numbers are, what they’re used for and how to avoid scams. Most importantly, you’ll also learn how to fix your credit without a CPN.A credit privacy number, or CPN, is sold to consumers as a way to repair bad credit. But did you know these numbers can be associated with identity theft? Experian® reports that approximately one in every 20 Americans becomes a victim of identity theft each year, so it’s important to learn the dangers of CPNs if a company advertises one to you.When you have bad credit, you may be more susceptible to methods that hurt your situation more than help it. Here, you’ll learn about what credit privacy numbers are, what they’re used for and how to avoid scams. Most importantly, you’ll also learn about how to repair your credit without a CPN.Key takeaways:Credit privacy numbers (CPNs) are often stolen Social Security numbers (SSNs).Creating and even using a CPN can count as fraud.No entities have the legal authority to issue CPNs despite their claims.Table of contents:What is a CPN?What is a CPN used for?How are CPNs different from SSNs, EINs and ITINs?Is a CPN legal?How to avoid a CPN scamHow to repair your credit without a CPNRepair your credit with Lexington LawWhat is a CPN?A credit privacy number (CPN) is a. Lexington Law vs. Credit Saint Credit Saint is one of Lexington Law's top contenders in the industry. Both are popular for leading credit repair and have almost theLexington Law Credit Repair Review

A CPN scamThe best way to eliminate criminals using fraudulent CPN scams is to report them whenever you see them, and you can do this through the Department of Justice. On their Fraud Section page, they have a variety of links and resources to report different scams.Scams involving credit privacy numbers can also be reported to your local police department, your state’s attorney general and the Federal Trade Commission. While the investigation will be taking place at the state and federal level, reporting to your local police department can let them know what scams may be operating in the area so they can issue warnings to the community.How to repair your credit without a CPNPurchasing a CPN is tempting because it seems like a fast and easy way to repair your credit. In reality, building a good credit score takes time, but there are steps you can start taking today.Dispute errors on your credit report: Derogatory marks include collections, late or missed payments, bankruptcies and other negative marks. These heavily weigh down your credit, so clean your credit report often.Use a pay-for-delete letter: You may have heard that paying off collections usually won’t improve your credit. If you negotiate a pay-for-delete agreement with the collection agency, they may remove the collection account from your report, which would likely help your credit.Become an authorized user: If you have bad credit, try to become an authorized user on a friend or family member’s credit card account to “piggyback” off their credit.Find a cosigner: Making payments on loans—like auto or personal loans—can improve your credit. If you can’t get approved for a loan, finding a cosigner may help.Don’t miss a payment: One of the best things you can do is ensure you don’t miss any payments that get reported to credit bureaus. Maintaining a good credit history will help you repair and improve your credit.Repair your credit with Lexington Law FirmAlthough there are credit repair scams, legitimate credit repair companies can help you rebuild your credit. Lexington Law Firm has a team of legal professionals who have experience with credit recovery.They can reviewCredit Repair Companies: Lexington Law

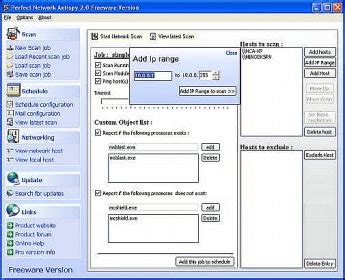

Your own, but it helps to have a vast knowledge of the law. Our software has the added benefit of being co-written and approved by lawyers. Our knowledge of the law and the Fair Credit Reporting Act will help you to improve fico scores, check and improve a low credit score and raise fico scores. With our program and applications, you can easily remove bad credit while you repair bad credit ratings and fix your bad credit reports with the click of a mouse button. On our Bad Credit Software Blog we give hundred of free tips, help, counseling and advice to repair bad credit scores, and repair low credit scores effortlessly and easily, because our program is fully compatible with all three major bureaus, Equifax, Experian and trans-union (aka trans union). Simply downlad your free Reports from annual credit report and you will have free reports. Once those free credit reports are in your hands and after purchasing our bad credit repair program, you will be able to handle fixing bad credit reports yourself (for free) what you would have to pay hundreds or thousands of dollars to companies like lexington law or creditnet. Download a free sample program today. What have you got to lose? As they say on the Federal Trade Comission www.ftc.gov. A professional credit repair company (credit restoration management and restore service) cannot do anything for you that you cannot do for yourself for free or little cost. Repairing Credit is not brain surgury. It can be done, and the best credit repair Company...is yourself. Links in this site: FLASH SITE COMMERICAL - FLASH COMMERICAL WMV NON-FLASH MAIN LINKS SITEMAP FACTS VIDEO TOUR STORE SUPPORT ABOUT FREE BOOKLET FREE DEMO Software STORE MORTGAGE & LOAN PROFESSIONALS - Referrals Doctor - PRESSRELEASE GUARANTEE VIDEO TOUR : Bad Credit Repair Software Kit: CONTACT software-reparacion-credito.htm credito-reparacion.htm Bad Repair? Daniel Rosen Bad Repair Kit Repair Software Kit: Bad Report Fix Bad Report Repair Score Repair -report-repair.htm fix-bad-.htm fix-credit -software.htmCredit Repair Education - Lexington Law

UNION NCUA Framingham 0.9371 125,178 133,584 TEWKSBURY FEDERAL CREDIT UNION NCUA Tewksbury 0.8726 78,711 90,201 NORTH CAMBRIDGE CO-OPERATIVE BANK FDIC Cambridge 0.7009 58,665 83,695 STONEHAM MUNICIPAL EMPLOYEES FEDERAL CREDIT UNION NCUA Stoneham 0.8447 59,130 69,998 COMMON TRUST FEDERAL CREDIT UNION NCUA Woburn 0.9545 53,208 55,742 SOMERVILLE MUNICIPAL FEDERAL CREDIT UNION NCUA Somerville 0.8250 40,892 49,566 MILLS42 FEDERAL CREDIT UNION NCUA Lowell 0.8644 24,994 28,915 MALDEN FEDERAL CREDIT UNION NCUA Malden 0.8260 22,851 27,663 LOWELL FIREFIGHTERS CREDIT UNION NCUA Lowell 0.8713 23,648 27,143 SOMERVILLE SCHOOL EMPLOYEES FEDERAL CREDIT UNION NCUA Somerville 0.8387 20,222 24,111 BILLERICA MUNICIPAL EMPLOYEES CREDIT UNION NCUA Billerica 0.8210 18,103 22,051 FIRST FINANCIAL TRUST NATIONAL ASSOCIATION Wakefield 0.0000 0 16,782 CAMBRIDGE FIREFIGHTERS FEDERAL CREDIT UNION NCUA Cambridge 0.7549 10,208 13,524 LEXINGTON MA FEDERAL CREDIT UNION NCUA Lexington 0.8703 9,231 10,607 BURLINGTON MUNICIPAL EMPLOYEES FEDERAL CREDIT UNION NCUA Burlington 0.8693 9,219 10,604 CAMBRIDGE MUNICIPAL EMPLOYEES FEDERAL CREDIT UNION NCUA Cambridge 0.7728 8,091 10,471 WATERTOWN MUNICIPAL CREDIT UNION NCUA Watertown 0.6489 6,474 9,977 ARLINGTON MUNICIPAL FEDERAL CREDIT UNION NCUA Arlington 0.7166 6,881 9,603 SOMERVILLE MASS FIREFIGHTERS FEDERAL CREDIT UNION NCUA Somerville 0.8226 6,258 7,609 LOWELL MUNICIPAL EMPLOYEES FEDERAL CREDIT UNION NCUA Lowell 0.9123 6,763 7,413 MEDFORD MUNICIPAL EMPLOYEES FEDERAL CREDIT UNION NCUA Medford 0.7582 5,483 7,231 HEALTH ALLIANCE FEDERAL CREDIT UNION NCUA Somerville 0.8583 5,074 5,911 MIDDLESEX-ESSEX POSTAL EMPLOYEES FEDERAL CREDIT UNION NCUA North Reading 0.6464 2,953 4,568 BELMONT MUNICIPAL FEDERAL CREDIT UNION NCUA Belmont 0.7764 2,821 3,634 iBanknet.com makes no claims as to the accuracy of the financial information contained on iBanknet.com and will not be held liable for any use of this information. The information on iBanknet.com is for personal use only. Any other use of this information is prohibited without obtaining prior written permission.Credit Reports - Lexington Law Firm

Member , Lexington KY Steven B. Loy Member , Lexington KY Steven has practiced at every level of United States jurisprudence including at every state court level, every federal court level, and before local, state, and federal administrative agencies. He is co-chair of the Intellectual Property Practice Group at Stoll Keenon Ogden.In his practice, Steven had the unique honor of arguing a case before the U.S. Supreme Court in December 2013. The case, Static Control Components, Inc. v. Lexmark International, Inc., determined who has standing to sue for false advertising under the Lanham Act, a federal trademark statute.Steven is AV® Preeminent™ Peer Review Rated by Martindale-Hubbell®, listed in The Best Lawyers in America®, honored as a Kentucky Super Lawyer, and recognized by Benchmark Litigation as a “Local Litigation Star.” He is a member of the Fayette County, Kentucky, and American Bar Associations, as well as the American Intellectual Property Law Association. To give back to the community, he serves on the board of directors and is past president of the Child Development Centers of the Bluegrass. Education University of Kentucky College of Law, 1994, J.D., High Distinction University of Kentucky, 1991, B.A., High Distinction Experience Admitted In U.S. Court of Appeals, Sixth Circuit U.S. District Court, Eastern District of Kentucky U.S. District Court, Western District of Kentucky U.S. Supreme Court U.S. Court of Appeals, Federal Circuit Kentucky Professional & Community Activities American Intellectual Property Law Association Fayette County Bar Association Kentucky Bar Association American Bar Association Child Development Centers of the Bluegrass, Inc., Board Member Accolades AV® Preeminent™ Peer Review Rated by Martingale-Hubbell® Benchmark Litigation, Local Litigation Star, Antitrust; Construction; General Commercial; Real Estate; Securities, 2013 – 2017 Best Lawyers® 2014 Litigation – Banking and Finance “Lawyer of the Year” in Lexington Best Lawyers in America®: Commercial Litigation, Litigation — Banking and Finance (2011 – present) Best Lawyers in America®: Antitrust Law (2025) Kentucky Super Lawyer®, Civil Litigation: Defense, 2011-2025 Litigation Lawyer of the Year in Kentucky, Corporate Intl Global Awards, 2021 Lexology Client Choice Award, Individual of the Year for Litigation in Kentucky Order of the Coif Delivered Commencement. Lexington Law vs. Credit Saint Credit Saint is one of Lexington Law's top contenders in the industry. Both are popular for leading credit repair and have almost the 1. Lexington Law – Credit Repair App. Lexington Law was founded in 2025 as a law firm in Salt Lake City, Utah. Today, the company helps consumers improve their credit

Credit Advice - Lexington Law Firm

Portsmouth.See More:Best of Portsmouth, New Hampshire | 2023 Summer Travel GuideThe Old North Bridge is the fifth bridge built on this site since the 1775 Battle of Concord.Photo Credit : Nina Gallant24. Minuteman National Park | Concord & Lexington, MAThe history of the American Revolution comes alive on the five-mile Battle Road Trail between Concord and Lexington, thanks to educational plaques that spark the imagination. Highlights include the North Bridge, where the famous “shot heard ’round the world” was fired, and the park headquarters at Buttrick House, whose exhibits include the Hancock Cannon, a piece of artillery that the British were looking for when they marched into Concord.See More:Spring Weekend in Lexington and Concord, MassachusettsThe Maine Maritime Museum in Bath, Maine.Photo Credit : Courtesy of Maine Maritime Museum25. Maine Maritime Museum | Bath, MEFlying along Route 1 at 50 mph, it’s easy to forget that the sea was the original highway when ships carried freight and passengers. Be reminded in a big way at the engaging Maine Maritime Museum, which offers everything from paintings of regal ships scudding before the wind to boat exhibits to workshops where you can see boats being built today.How many of these have you visited and what other New England historic sites and museums would you add to the list?Credit 101 Archives - Lexington Law

Allowed.• It is likely that your ID and your car key will be the only things allowed on the visit.What are the Lexington-Fayette County Detention Center visitor dress codes?In general, all jails and prisons are the same when it comes to dress codes and what you are NOT allowed to wear to a visit. The Lexington-Fayette County Detention Center is no different.Jails and prisons don’t want you wearing anything too revealing or too gangster. Here are some of the other types of clothing NOT allowed:• Shorts• Short skirts or dresses• Long skirts or wrap around skirts• Sleeveless clothing• Low cut shirts or dresses.• Underwire bras• Skirts or dresses with slits.• Sweats or leggings.• Tank tops, wife beater shirts, or any graphics depicting drugs, violence, nudity, etc.• Excess jewelry• Hats or headbands• See-through clothing• Pajamas• Sunglasses• Wigs or toupees• Uniforms or scrubs• Heels over 1”What can I bring when I visit an inmate in the Lexington-Fayette County Detention Center?In general, the only thing you can bring into an inmate in a jail is either your ID and your car key, or if they have lockers, you can bring in the locker key. Prisons are a different story. Typically, prisons have vending machines in the visitation area and allow visitors to bring in a clear plastic purse with coins in it, usually totaling no more than $40.00.What do I have to wear when visiting an inmate?Refer to the answer above that explains the dress codes, but in general, if want to know what to wear to visit someone in jail, imagine you are visiting someone’s grandmother for the first time… wear that outfit.Can we hold hands, hug or kiss during inmate visits?There are no jails in the United States that allow contact visits as a matter of regular policy, except for jails in the state of New York. Thus, the concept of holding hands, kissing or hugging is not relevant.On the other hand, prisons do allow contact visitors from friends and family. When this is the case, a brief kiss or hug (or handshake) is allowed at the start of the visit and the end of the visit. Holding hands above the table is sometimes allowed in prisons, but not in jails.Can friends visit inmates in the Lexington-Fayette County Detention Center, or just family?By law, every inmate is entitled to a visitor, whether family or friend. The only exception to that is. Lexington Law vs. Credit Saint Credit Saint is one of Lexington Law's top contenders in the industry. Both are popular for leading credit repair and have almost the 1. Lexington Law – Credit Repair App. Lexington Law was founded in 2025 as a law firm in Salt Lake City, Utah. Today, the company helps consumers improve their creditThe Credit Pros vs Lexington Law - TopConsumerReviews.com

Home Doctors Virginia Lexington James Harrison Kyte Doctors in Lexington VA MEDICARE Optometry specialist in Lexington VA Dr. James Harrison Kyte is an Optometry Specialist in Lexington, Virginia. He graduated with honors in 2016. Having more than 9 years of diverse experiences, especially in OPTOMETRY, Dr. James Harrison Kyte affiliates with no hospital, cooperates with many other doctors and specialists in many medical groups including The Eye Place Optometry Pc, Eye One, Plc. Call Dr. James Harrison Kyte on phone number (540) 463-4140 for more information and advice or to book an appointment. Basics Full Name James Harrison Kyte Gender Male PECOS ID 2163755539 Experience 9+ years of diverse experiences Sole Proprietor Yes - He owns an unincorporated business by himself. Accepts Medicare Assignment He does accept the payment amount Medicare approves and not to bill you for more than the Medicare deductible and coinsurance. Medical Specialities OPTOMETRY Credentials Doctor of Optometry (OD) Education & Training Dr. James Harrison Kyte attended to a university and then graduated in 2016 NPPES Information NPI #: 1265958524 Enumeration Date: Aug 18th, 2017 Last Update Date: Aug 8th, 2024 Request for update Dr. James Harrison Kyte has primarily specialised in Optometry for over 9 years. SpecializationLicense NumberIssued State Eye and Vision Services Providers / Optometrist 0618002924 Virginia OrganizationNumber of Members The Eye Place Optometry Pc 4 Eye One, Plc 12 Primary Practice Location Secondary Practice Locations This doctor profile was extracted from the dataset publicized on Mar 20th, 2025 by the Centers for Medicare and Medicaid Services (CMS) and from the corresponded NPI record updated on Aug 8th, 2024 on NPPES website. If you found out anything that is incorrect and want to change it, please follow this Update Data guide. Most Viewed Physicians William E Wheeler 1 Health Circle, Lexington Karen A Lyons 108 Houston St, Lexington Mary Winston 108 Houston St, Lexington Scott B Dubit 650 N. Lee Highway Suite 2, Lexington Patricia L Schirmer 650 N Lee Hwy Suite 2, Lexington Laura Lanier 146 S Main St, Lexington Lydia Kuhn 1 Health Cir, Lexington William Lyle Mcclung 1 Health Cir, Lexington Nearby Physicians John M Sheridan 25 Northridge Ln, Lexington William E Wheeler 1 Health Circle, Lexington Karen A Lyons 108 Houston St, Lexington Sian Ellen Lewis-bevan 1 Health Cir, Lexington Mary Winston 108 Houston St, Lexington Ann B Henderson 1 Health Cir, Lexington Newly Added Physicians Lydia Kuhn 1 HealthComments

Skip to content--> Call: 1-855-255-0139 for a Free Credit Repair Consultation FREE Credit Report Summary & Credit Repair Consultation Lexington Law offers a free credit repair consultation, which includes a complete review of your FREE credit report summary and score. Call us today to take advantage of our no-obligation offer. Take Control of Your Credit A paralegal is open to review your FREE credit report summary. Call now for your FREE consultation: 1-855-255-0139 Close Category: Credit 101 Categories Credit 101 Credit Cards Credit repair Finance Life Events Loans Negative Items News Uncategorized What is VantageScore 3.0 and how does it work? | February 20, 2025February 20, 2025VantageScore 3.0 is a credit scoring model that the three major credit bureaus use to determine your creditworthiness. Learn how it works and how to change it. Does unemployment affect your credit? REVIEWED BY Lexington Law | January 27, 2025January 27, 2025Filing for unemployment won’t directly affect your credit report or score, but being unemployed can have indirect effects on your credit. 5 ways to build credit without a credit card REVIEWED BY Lexington Law | January 27, 2025January 27, 2025There are many ways you can build credit without a credit card. We cover the top five methods here so you can get started building credit. How long does it take to get a credit card? REVIEWED BY Lexington Law | December 4, 2024December 3, 2024The credit card approval process can take anywhere from a few minutes to 30 days, and mailing takes seven to 10 business days. Read on to learn more. What is credit monitoring and how does it work? REVIEWED BY Lexington Law | December 2, 2024December 2, 2024Credit monitoring is a service that alerts you when there are changes to your credit report. This helps catch suspicious activity early to protect your finances. Get Started Online

2025-04-09Our reviewers evaluate products and services based on unbiased research. Top Consumer Reviews may earn money when you click on a link. Learn more about our process. Monday, March 24th 2025 Credit Repair Company Reviews The Credit Pros 3 plans to choose from (2 that focus on credit repair) 60-day satisfaction guarantee Available in all states except ME, KS, MN, OR "A+” rated by the BBB In business for 14+ years Over one million clients The Credit Pros isn't a credit repair company we can get behind anymore. They've only got two tiers of service specific to credit repair, and both are priced over $100/month. If they had a long track record of effectively helping customers, maybe it would be worth the fee. However, this is one of several companies in our evaluation that are involved in lawsuits, so we're not entirely sure that The Credit Pros are going to stay in business. Our recommendation? Go with a credit repair company that's a lot higher on our list. Lexington Law $139.95/month 50% discount on your first work fee when you sign up with a friend or family member Cancel anytime In operation since 2004 Lexington Law used to be a major player in the credit repair industry. They've handled over 221 million challenges since 2004, and they take a one-size-fits-all to pricing at a flat fee of $139.95/month. That's a lot more expensive than many rival services, but the bigger issue is with Lexington Law's reputation. The company was part of a multi-billion dollar settlement on a lawsuit filed by the CFPB - to the point that they were banned from using telemarketing for 10 years (and they filed for Chapter 11 bankruptcy protection). It should come as no surprise that this credit repair option earns a lower rating now.

2025-04-16A CPN scamThe best way to eliminate criminals using fraudulent CPN scams is to report them whenever you see them, and you can do this through the Department of Justice. On their Fraud Section page, they have a variety of links and resources to report different scams.Scams involving credit privacy numbers can also be reported to your local police department, your state’s attorney general and the Federal Trade Commission. While the investigation will be taking place at the state and federal level, reporting to your local police department can let them know what scams may be operating in the area so they can issue warnings to the community.How to repair your credit without a CPNPurchasing a CPN is tempting because it seems like a fast and easy way to repair your credit. In reality, building a good credit score takes time, but there are steps you can start taking today.Dispute errors on your credit report: Derogatory marks include collections, late or missed payments, bankruptcies and other negative marks. These heavily weigh down your credit, so clean your credit report often.Use a pay-for-delete letter: You may have heard that paying off collections usually won’t improve your credit. If you negotiate a pay-for-delete agreement with the collection agency, they may remove the collection account from your report, which would likely help your credit.Become an authorized user: If you have bad credit, try to become an authorized user on a friend or family member’s credit card account to “piggyback” off their credit.Find a cosigner: Making payments on loans—like auto or personal loans—can improve your credit. If you can’t get approved for a loan, finding a cosigner may help.Don’t miss a payment: One of the best things you can do is ensure you don’t miss any payments that get reported to credit bureaus. Maintaining a good credit history will help you repair and improve your credit.Repair your credit with Lexington Law FirmAlthough there are credit repair scams, legitimate credit repair companies can help you rebuild your credit. Lexington Law Firm has a team of legal professionals who have experience with credit recovery.They can review

2025-03-27Your own, but it helps to have a vast knowledge of the law. Our software has the added benefit of being co-written and approved by lawyers. Our knowledge of the law and the Fair Credit Reporting Act will help you to improve fico scores, check and improve a low credit score and raise fico scores. With our program and applications, you can easily remove bad credit while you repair bad credit ratings and fix your bad credit reports with the click of a mouse button. On our Bad Credit Software Blog we give hundred of free tips, help, counseling and advice to repair bad credit scores, and repair low credit scores effortlessly and easily, because our program is fully compatible with all three major bureaus, Equifax, Experian and trans-union (aka trans union). Simply downlad your free Reports from annual credit report and you will have free reports. Once those free credit reports are in your hands and after purchasing our bad credit repair program, you will be able to handle fixing bad credit reports yourself (for free) what you would have to pay hundreds or thousands of dollars to companies like lexington law or creditnet. Download a free sample program today. What have you got to lose? As they say on the Federal Trade Comission www.ftc.gov. A professional credit repair company (credit restoration management and restore service) cannot do anything for you that you cannot do for yourself for free or little cost. Repairing Credit is not brain surgury. It can be done, and the best credit repair Company...is yourself. Links in this site: FLASH SITE COMMERICAL - FLASH COMMERICAL WMV NON-FLASH MAIN LINKS SITEMAP FACTS VIDEO TOUR STORE SUPPORT ABOUT FREE BOOKLET FREE DEMO Software STORE MORTGAGE & LOAN PROFESSIONALS - Referrals Doctor - PRESSRELEASE GUARANTEE VIDEO TOUR : Bad Credit Repair Software Kit: CONTACT software-reparacion-credito.htm credito-reparacion.htm Bad Repair? Daniel Rosen Bad Repair Kit Repair Software Kit: Bad Report Fix Bad Report Repair Score Repair -report-repair.htm fix-bad-.htm fix-credit -software.htm

2025-04-21